Latest News

Celebrating ‘Erving’s living room’: Library marks fifth anniversary

ERVING — While the COVID-19 virus began raising alarm in March 2020, former Erving Public Library Director Barbara Friedman recalls being skeptical of the pandemic shutting down the new library, which had just opened to the public on March 1.

Franklin Tech English teacher honored for bringing ‘the very best’ out of students

TURNERS FALLS — Franklin County Technical School English teacher Jay Butynski describes himself as “a goofball by nature,” a quality he doesn’t hide from students who have come to find his classroom a safe and engaging place.

Most Read

The ills of a billion-dollar enterprise: The slow-death of the cannabis industry, and what might be done to reverse the trend

The ills of a billion-dollar enterprise: The slow-death of the cannabis industry, and what might be done to reverse the trend

Former Mohawk Trail ski coach, Rowe park manager sued for alleged sexual assault of former student

Former Mohawk Trail ski coach, Rowe park manager sued for alleged sexual assault of former student

NCAA Div. 1 Men’s Ice Hockey: UMass stuns Minnesota 5-4 in OT, advances to regional final

NCAA Div. 1 Men’s Ice Hockey: UMass stuns Minnesota 5-4 in OT, advances to regional final

Driver unharmed after Brook Road crash in Shelburne

Driver unharmed after Brook Road crash in Shelburne

Dismantling of former Zion Korean Church underway in Greenfield

Dismantling of former Zion Korean Church underway in Greenfield

Sex assault complaint spurs review at Mohawk Trail Regional School District

Sex assault complaint spurs review at Mohawk Trail Regional School District

Editors Picks

Montague and Erving Notebook: March 28, 2025

Montague and Erving Notebook: March 28, 2025

Business Briefs: March 28, 2025

Business Briefs: March 28, 2025

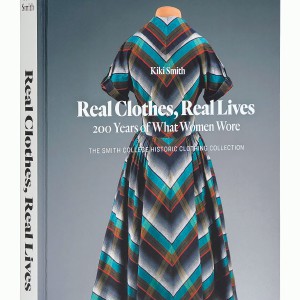

Women’s history told through clothing: Shelburne Falls Area Women’s Club to host ‘Real Clothes, Real Lives: 200 Years of What Women Wore’ author, April 9

Women’s history told through clothing: Shelburne Falls Area Women’s Club to host ‘Real Clothes, Real Lives: 200 Years of What Women Wore’ author, April 9

Regional Notebook: March 29, 2025

Regional Notebook: March 29, 2025

Sports

HS Roundup: Frontier baseball moves to 2-0 following 7-3 triumph over Hampshire

SOUTH DEERFIELD — It’s been the start to the season Frontier baseball coach Chris Williams envisioned.

Keeping Score with Chip Ainsworth: Spring training in Florida: Part 2

Keeping Score with Chip Ainsworth: Spring training in Florida: Part 2

Opinion

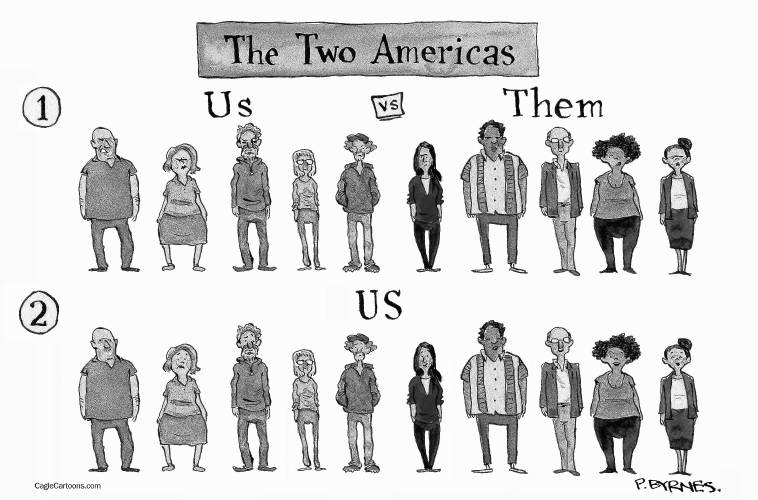

My Turn: First, they came for the idea of the common good

Letter: Striking Parallels to Nazism

Letter: Striking Parallels to Nazism

Linda and Bill Oldach: Grosky for selectman

Linda and Bill Oldach: Grosky for selectman

My Turn: Slashing of farming, food support senseless

My Turn: Slashing of farming, food support senseless

My Turn: Cleared for an Ichetucknee River paddle

My Turn: Cleared for an Ichetucknee River paddle

Your Daily Puzzles

An approachable redesign to a classic. Explore our "hints."

A quick daily flip. Finally, someone cracked the code on digital jigsaw puzzles.

Chess but with chaos: Every day is a unique, wacky board.

Word search but as a strategy game. Clearing the board feels really good.

Align the letters in just the right way to spell a word. And then more words.

Business

Creating a ‘mecca of local art’: JJ White opening Art Deviation Gallery & Store in Greenfield

GREENFIELD — The soon-to-open storefront at 365 Main St. will not be the first Art Deviation Gallery & Store that Greenfield resident JJ White has owned, but it will differ from the one that operated briefly in South Deerfield in 2020.

Out with fast fashion, in with sustainability: The Sparkle Cave clothing store opens in Greenfield

Out with fast fashion, in with sustainability: The Sparkle Cave clothing store opens in Greenfield

Greenfield Starbucks pours its first cup

Greenfield Starbucks pours its first cup

Greenfield Starbucks provides update for opening day

Greenfield Starbucks provides update for opening day

A ‘grande’ opening ahead: Greenfield Starbucks to open its doors Monday

A ‘grande’ opening ahead: Greenfield Starbucks to open its doors Monday

Arts & Life

Valley Bounty: And on that farm she had a bit of everything: Little Brook Farm in Sunderland is a labor of love for farmer Kristen Whittle

Spring is here, and with it are signs of new life on farms around the Valley. Leaves are beginning to bud on fruit trees, farmers are preparing soil for the coming growing season, and at Little Brook Farm in Sunderland, day-old baby lambs are bounding around the lambing barn.

Obituaries

Elizabeth York

Elizabeth York

Elizabeth "Betty" York Rocky Point, NY - Elizabeth "Betty" York, 84, of Rocky Point, NY passed away peacefully on March 14th, 2025 at Saint Charles Hospice. Betty was born on January 10th, 1941 in Brownington, VT to the late Elwin LaFoe... remainder of obit for Elizabeth York

David Nieskoski

David Nieskoski

Ukiah, CA - David Joseph Nieskoski died unexpectedly of a heart attack, in bed at his Ukiah, CA, home, on January 27, 2024. His ashes are now mixed with soils beneath a Japanese maple tree in his Ukiah garden and under a stand of trees ... remainder of obit for David Nieskoski

Linda M. Molloy

Linda M. Molloy

Turners Falls, MA - Linda M. (Gibson) Molloy, 77, of Bulkley St. passed away Saturday March 22, 2025, at home. She was born in Montague April 4, 1947, the daughter of Paul and Rita (Momaney) Gibson. Linda attended local schools and grad... remainder of obit for Linda M. Molloy

Eleanor Ann Fisher

Eleanor Ann Fisher

Brattleboro, VT - Eleanor Ann (Reynolds) Fisher 86, (formerly from Greenfield, MA) passed away peacefully on Monday, March 24th, 2025, in Brattleboro, VT at home with her family by her side. Born in South Hero, VT on July 13th, 1941, s... remainder of obit for Eleanor Ann Fisher

Four Rivers students participate in overdose response training

Four Rivers students participate in overdose response training

Greenfield Fire Station’s energy use 250% higher than expected

Greenfield Fire Station’s energy use 250% higher than expected

Orange residents provide input on long-range plan

Orange residents provide input on long-range plan

Franklin County Chamber of Commerce breakfast shines spotlight on family businesses

Franklin County Chamber of Commerce breakfast shines spotlight on family businesses

No injuries result from crash at Main, Hope streets in Greenfield

No injuries result from crash at Main, Hope streets in Greenfield

Having adapted over time, Whately Grange celebrating 85 years

Having adapted over time, Whately Grange celebrating 85 years

The World Keeps Turning: Free speech is a cornerstone of America

The World Keeps Turning: Free speech is a cornerstone of America

Beacon Hill Roll Call: March 17 to March 21, 2025

Beacon Hill Roll Call: March 17 to March 21, 2025

NCAA Div. 1 Men’s Ice Hockey: UMass stuns Minnesota 5-4 in OT, advances to regional final

NCAA Div. 1 Men’s Ice Hockey: UMass stuns Minnesota 5-4 in OT, advances to regional final  Greenfield boys tennis team returns to the court for the first time since 2021

Greenfield boys tennis team returns to the court for the first time since 2021 NCAA Div. 1 Men’s Ice Hockey: UMass stuns Minnesota 5-4 in OT, advances to regional final

NCAA Div. 1 Men’s Ice Hockey: UMass stuns Minnesota 5-4 in OT, advances to regional final  Record-breaking athlete turned renowned artist: Peter Ruhf, whose work is on display at Greenfield’s TEOLOS gallery, was once a boomerang champion

Record-breaking athlete turned renowned artist: Peter Ruhf, whose work is on display at Greenfield’s TEOLOS gallery, was once a boomerang champion ‘A woman who should be remembered’: New play about the life of Frances Perkins, the brains behind FDR’s New Deal, April 5 and 11

‘A woman who should be remembered’: New play about the life of Frances Perkins, the brains behind FDR’s New Deal, April 5 and 11 Earth Matters: Do plants know math? Three Valley plants share a surprising secret

Earth Matters: Do plants know math? Three Valley plants share a surprising secret Fish theme brought varied approaches: Three films awarded at fifth annual Lights! Camera! Greenfield! competition

Fish theme brought varied approaches: Three films awarded at fifth annual Lights! Camera! Greenfield! competition