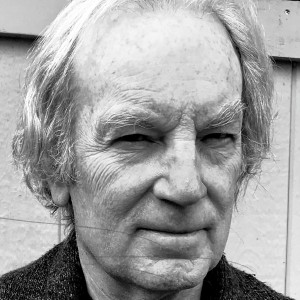

John Hoffman: A fairer way for towns to tax?

Kaboompics.com

| Published: 01-28-2025 2:43 PM |

Nearly 30 years ago, just after my wife and I moved to Charlemont to begin a farm, a piece appeared in the Recorder that caught my attention. I’ve been waiting for its logic to assert itself, but since it hasn’t yet, I am going to repeat what I remember of it.

The author observed that when our towns decided to finance themselves through a tax on real estate, there was a rough equivalence between one’s overall wealth and one’s property. A larger farm generally signified greater wealth.

That correlation no longer obtains. One can work in a small home office and make a great deal of money, and that fact is not reflected in one’s real estate taxes.

The correlation that does exist, still imperfectly, is between wealth and income. Why do we not raise revenues for our town by a tax on incomes? Would that not be intrinsically more fair?

The information is readily at hand through our federal income tax returns. All we would need to do would be to calculate the rate of tax needed to fund our budgets and then levy the rate according to income. It would be very interesting, if only as a thought experiment, to see what those numbers look like.

I don’t know how to make that happen, but I believe that our town — and all our towns — would rest upon a more just foundation if we raised money proportional to our ability to pay, not according to the property we happen to own.

John Hoffman

Charlemont

Article continues after...

Yesterday's Most Read Articles

Four Red Fire Farm workers arrested as part of ICE operation in Springfield

Four Red Fire Farm workers arrested as part of ICE operation in Springfield

Avery’s General Store building in Charlemont for sale

Avery’s General Store building in Charlemont for sale

Greenfield seeks renewal of Slum and Blight designation to bring in funds for infrastructure

Greenfield seeks renewal of Slum and Blight designation to bring in funds for infrastructure

Amherst’s Ryan Leonard signs entry-level contract with Capitals, expected to make NHL debut Tuesday in Boston against the Bruins

Amherst’s Ryan Leonard signs entry-level contract with Capitals, expected to make NHL debut Tuesday in Boston against the Bruins

Greenfield Fire Station’s energy use 250% higher than expected

Greenfield Fire Station’s energy use 250% higher than expected

The ills of a billion-dollar enterprise: The slow-death of the cannabis industry, and what might be done to reverse the trend

The ills of a billion-dollar enterprise: The slow-death of the cannabis industry, and what might be done to reverse the trend

Pushback: The growing crowd next door

Pushback: The growing crowd next door Mike Naughton: Gerrymandering not the answer

Mike Naughton: Gerrymandering not the answer Nelson Shifflett: Lead and we will follow

Nelson Shifflett: Lead and we will follow My Turn: The latest ‘white backlash’

My Turn: The latest ‘white backlash’